The intersection of finance and IT, often referred to as “fintech,” has been rapidly growing in recent years, bringing numerous benefits to both industries.

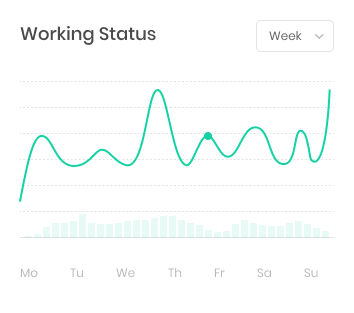

Technology automates processes in fintechorganizations

Open banking

An increasing number of financial institutions are transitioning to digital banking, digital wallets, and online banking in order to offer consumers a more convenient and easily accessible experience.

Artificial intelligence

Banks automate fraud detection, credit scoring, and customer service with AI and ML. These technologies can reduce errors, boost efficiency, and personalize services.

Big data and analytics

Big data and analytics help banks understand customer behavior, operational efficiency, and market trends. These insights aid decision-making, operations optimization, and product development.

Cloud computing

To scale, adapt, and save money, banks are moving to the cloud. Cloud computing can reduce infrastructure costs, improve disaster recovery, and enable remote work.

We remain current on the most recent technologies and trends in order to guarantee the prosperity of financial institutions. By harnessing the potential of technology to assist in enhancing banking industry safety, efficiency, and consumer satisfaction.

Financial services IT proves successful.

Technology has enabled financial institutions to obtain insights into customer behavior, market trends, and risk management through the use of big data and analytics. By utilizing these insights, one can enhance decision-making processes, streamline operations, and generate novel products and services.

Technology has enabled fintech startups to disrupt traditional financial services by providing innovative solutions, such as peer-to-peer lending, mobile payments, and robo-advisory